1–5 mins

Daily

Effort: Moderate

-

Ingredient: Financial Security & Stability

Feeling secure and confident about your finances.

How

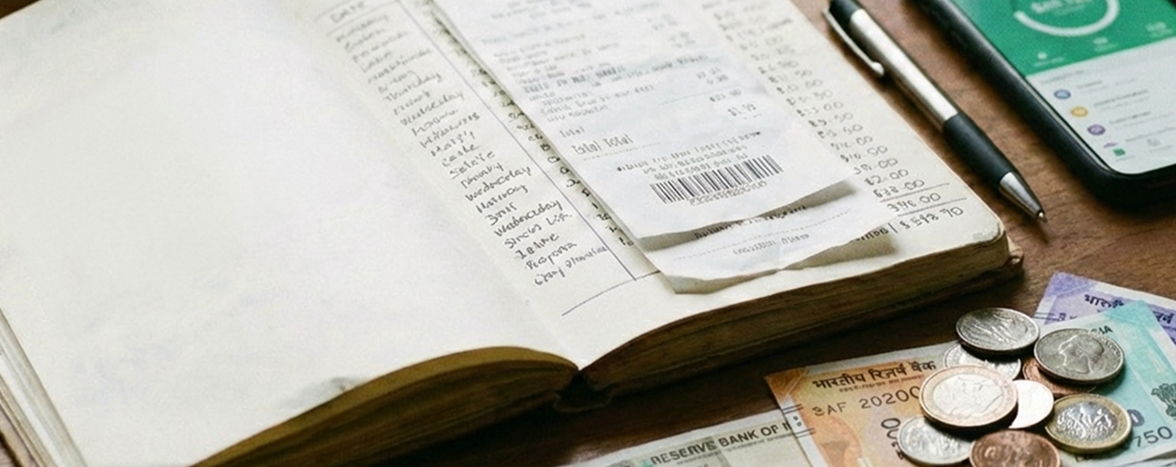

Pick a simple method: notes app, WhatsApp-to-self, a tiny notebook, or any basic expense app. Create 5–6 broad buckets (Food, Transport, Home, Health, Personal, Misc).

Log it right away (takes ~10–20 sec): amount + bucket + one word (e.g., “coffee,” “auto”). For cash, snap a photo of the bill if you’re in a rush and write it later.

Weekly 10–15 min check: total each bucket, circle 1–2 leaks and set one tiny tweak for next week (e.g., “auto twice → metro once”).

Easy Start

For today only, note every spend in one list. Add buckets this weekend.

Why It Matters

Questions and Thoughts

- “I’ll forget.” → Log immediately or drop a photo into a “to-log” album and clear it nightly. Set a 9pm reminder.

- “Shared household; hard to split.” → Track just your spends first or tag shared ones with “shared” and total them separately.

- “Feels judgy.” → Use neutral labels (“food out,” “ride”) - no good/bad words. The goal is seeing, not scolding.

- “Privacy.” → If using apps, avoid ones asking for bank SMS access; or stick to notes. Lock your notes with a passcode if needed.

Care Notes

Never store OTP/PIN/card numbers. Be cautious with apps that read SMS or need wide permissions. If money tracking spikes anxiety, track totals by bucket rather than every line, and take a breather day.

Add to calendar

Add to calendar  Print

Print Share

Share